The possession passions of investors are stood for by 'devices', which are issued and retrieved in a manner comparable to a system depend on. The CCF is an unincorporated body, not a separate lawful entity and is transparent for Irish lawful and tax functions. Because of this, capitalists in a CCF are treated as if they straight possess a proportionate share of the underlying financial investments of the CCF as opposed to shares or units in an entity which itself possesses the underlying financial investments.

Tax obligation transparency is the major feature, which separates the CCF from various other kinds of Irish funds. The CCF is authorized and regulated by the Reserve bank. Please note that this site is not planned to answer inquiries concerning private financial investments neither is it meant to give professional or lawful advice.

We believe all systems ought to hand down voting civil liberties for the firms you invest in, so you can have your claim as an investor. Numerous systems do this if you 'decide in', but others do not, which leaves capitalists in the dark or even not able to vote. The AIC's 'My share, my vote' project is dealing with to change this.

The act also offers the regulation of common fund managers by CIMA. Not all mutual funds are managed. The MFL defines the classifications of shared fund that are excluded from regulation. Funds that meet the criteria established out in section 4( 4) of the MFL are excluded. All various other mutual funds are controlled.

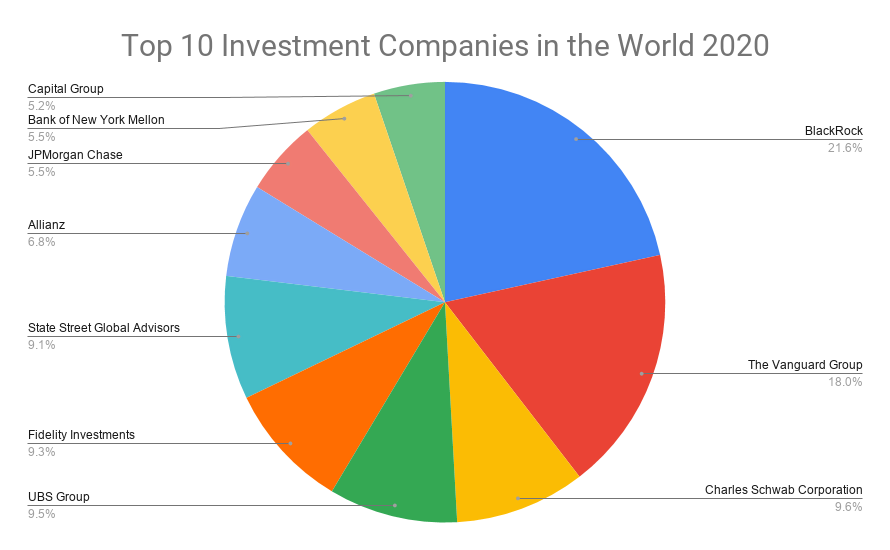

Investment Firms

The categories of funds managed under the MFL are set out below. The MFL (Area 4( 1 )) defines that a common fund operating in and from the Cayman Islands have to have a licence unless: a qualified common fund manager is giving its principal office; it fulfills the criteria laid out in Section 4( 3 ), which enables for funds to be signed up, or it is excluded from guideline under Area 4( 4 ).

The four vehicles generally made use of for operating common funds are the exempted firm, the segregated portfolio firm, the device count on and the excused minimal collaboration. The exempted firm might retrieve or acquire its very own shares and might as a result operate as a flexible company fund. Closed-ended company funds can likewise be established using the spared business and it is a relatively straightforward procedure to transform from one to the other.

The SPC makes it possible to supply a method for various teams to safeguard their assets when bring on company through a single lawful entity. The system trust is normally established under a trust fund deed with the financiers' passion held as trust fund devices. The spared and limited partnership gives a second unincorporated vehicle and it can be developed as conveniently as the spared business or the system trust.

Have you experienced a significant event in your life that has changed your economic situation?!? Possibly you're looking for a person to aid establish a roadway map for your monetary future. These and various other circumstances might make you consider calling a financial investment professional.

Investment Management servicing Conroe

Below are the most common kinds of financial investment specialists and key features. Lawyers use lawful assistance to clients associated to financial preparation and financial investment decisions and might represent customers in disputes with companies or financial investment professionals. A great place to begin when buying for a financial investment expert is to ask household, friends and colleagues that currently spend for the names of individuals they have actually used.

The complying with activities will aid you make an audio choice:, consisting of checking to see if an individual has a rap sheet. Do this you sign any type of files, make any kind of investments or pass on any cash. An essential action in choosing an investment professional is to see if the private and their firm are signed up.

The SEC Has helpful info and suggestions on exactly how to select a financial investment expert. These consist of: What experience do you have collaborating with individuals like me? Who are you signed up with and in what capability? Do you hold any various other expert credentials? Do you have any kind of disciplinary actions, arbitration awards or consumer grievances? If so, please discuss them.

Investment Company

Level with your expert regarding your investing experience and the amount of risk you're willing to take. Steer clear of any type of financial investment specialist who presses you to invest rapidly or refuses to offer information for you to consider carefully.

An American depositary invoice (ADR) is a certification representing shares of a foreign safety and security. It is a kind of indirect ownership of international securities that are not traded directly on a national exchange in the United States. Monetary establishments purchase the underlying safety and securities on forexes via their international branches, and these international branches stay the custodians of the securities.

Many ADRs are signed up with the united state Securities and Exchange Payment and traded on nationwide exchanges; nonetheless, some ADRs are not registered and traded on national exchanges. Capitalists purchase these non-registered ADRs directly from their companies or through various other private trades (i.e., "nonprescription"). An "American depositary share" represents a solitary share of the hidden security.

Navigation

Latest Posts

Landscape Design Contractor servicing Conroe

Investment Management Companies

Investment Management in Conroe, Texas